Thinking about building your dream home while you still own another? It’s a dream on many people’s bucket list but it brings its unique set of complexities.

The idea of crafting a home that reflects your unique taste and lifestyle is exciting. However, planning and managing the construction of a new house while trying to sell your existing one can seem like a mountainous task.

The challenges may range from working out the finances, dealing with overlapping costs, to finding temporary housing. You might feel overwhelmed just contemplating how to build a new home while having ownership of another.

At Bonsai Builders, we understand these complex intricacies and are here to help guide you through the process. We work with high-end homeowners in Massachusetts, like yourself, who don’t want to compromise on quality and attention to detail.

Table of Contents

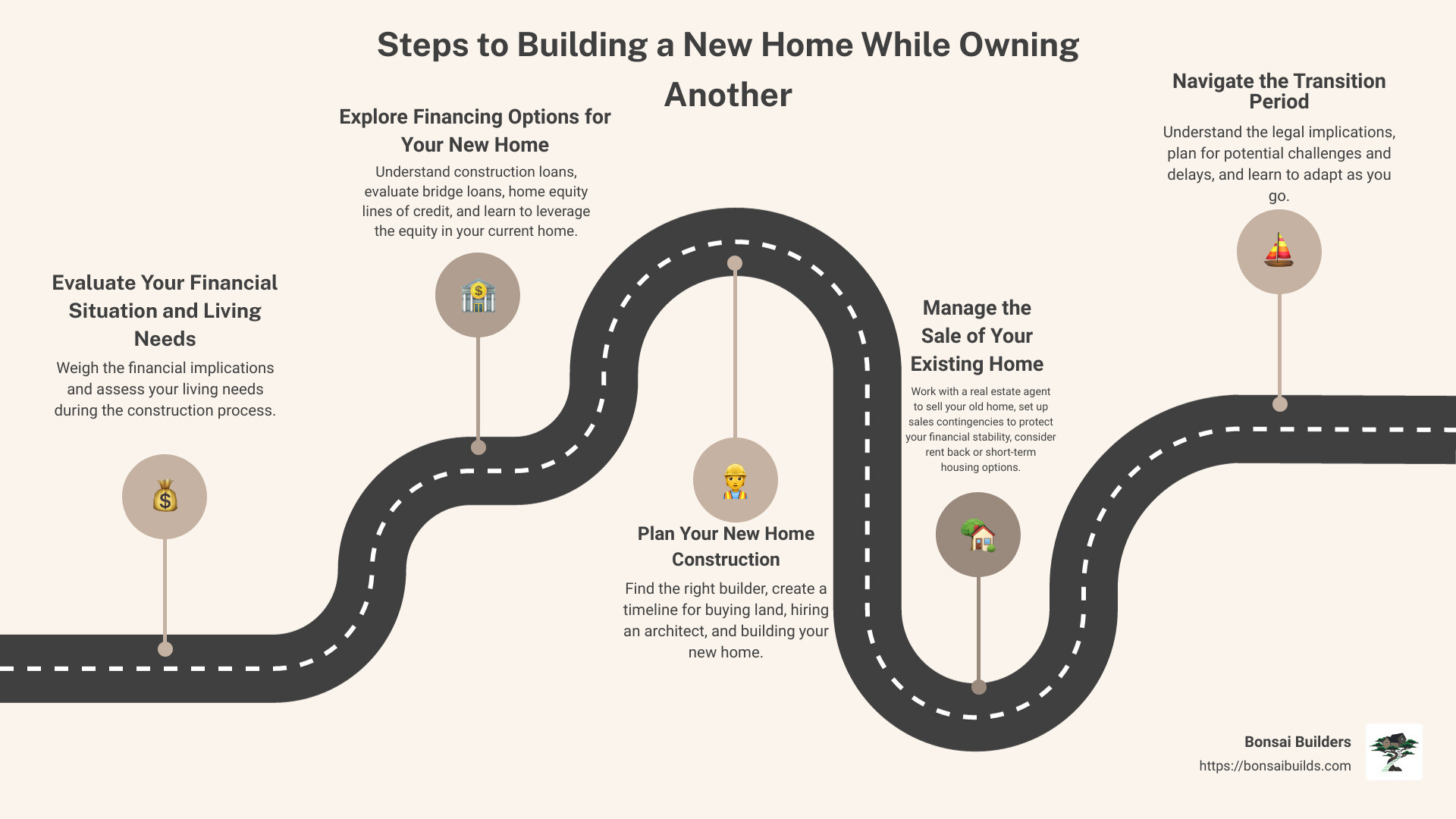

How to Build a New Home While Owning Another in 5 brief steps:

- Evaluate Your Financial Situation and Living Needs: weigh the financial implications and assess your living needs during the construction process.

- Explore Financing Options for Your New Home: understand construction loans and their requirements, evaluate bridge loans, home equity lines of credit, and borrowing against your 401k, and learn how to leverage the equity in your current home.

- Plan Your New Home Construction: find the right builder for your new home, create a timeline for buying land, hiring an architect, and building your new home.

- Manage the Sale of Your Existing Home: work with a real estate agent to sell your old home, set up sales contingencies to protect your financial stability, and rent back your old home or find a short-term housing option.

- Navigate the Transition Period: understand the legal implications, plan for potential challenges and delays, and learn to adapt as you go.

Diving into each one of these steps will provide a clearer understanding and guide you on how to confidently juggle building a new home while selling your old one. Follow through as we unpack each of these steps in more detail.

Step 1: Evaluate Your Financial Situation and Living Needs

Building a new home while owning another is an exciting endeavor. However, it requires careful financial planning and a clear understanding of your living needs throughout the construction process.

Understanding the Financial Implications of Building a New Home While Owning Another

One of the biggest hurdles in building a new home while owning another is financing. As our expert Kristin Hintlian states, “Building a home before you sell yours can stretch almost any budget.” You have to account for the construction costs of the new home while still paying the mortgage on your existing property; taking into account that you will have two mortgages.

It’s crucial to run the numbers and assess how this major decision impacts your financial future. You’ll need to estimate not only the selling price of your current home, but also the anticipated construction costs for your new one.

Assessing Your Living Needs During the Construction Process

Navigating the timelines of selling your current home and moving into your newly built one can be tricky. Delays in construction are common, and this can extend your timeline significantly. So, it’s important to prepare for such scenarios in advance to prevent undue stress.

You’ll also need to consider the logistics of where you’ll live during the construction process. Short-term renting, rent-back agreements, or staying with family are all viable options. You may desire to move only once, but building a new home while selling yours often requires flexibility and contingency plans.

In this step, it’s beneficial to create a timeline for your construction process. Whether you’re buying land to build on, or if your builder is offering new construction on a plot they already own, understanding the timing is essential.

Building a new home allows you to design a space tailored to your exact needs. Whether you’re accommodating a growing family or creating a dedicated work-from-home area, you have the freedom to customize your new home to fit your lifestyle.

In the end, understanding the financial implications and assessing your living needs will allow you to successfully navigate the process of how to build a new home while owning another. In the next step, we’ll explore the financing options for your new home.

Step 2: Explore Financing Options for Your New Home

Building a new home while owning another requires a good understanding of the financing options available. These options may include construction loans, bridge loans, home equity lines of credit (HELOC), and even borrowing against your 401K.

Importance of a Construction Loan, Down Payment and Debt to Income Ratio

Construction loans, also known as self-build loans, are different from traditional mortgages. They typically have a maximum term of one year and cover the construction costs associated with building your custom home. After the construction is finished, most homeowners refinance their construction loan into a traditional mortgage.

To secure a construction loan, lenders usually require a minimum down payment of 20% to 25% as they are generally viewed as riskier than mortgages. They also require a good debt to income ratio to qualify, which means your existing mortgage balance plays a crucial role. On average, lenders prefer a DTI less than 32%, but the exact criteria can vary.

Other Financing Options: Bridge Loans, Home Equity Line of Credit, and Borrowing Against Your 401K

If you prefer to stay in your current home while building a new one, you may need to explore other financing options.

One such option is a bridge loan, a short-term loan used to fund the purchase of a new property before a homeowner has sold their existing one. However, they typically have high-interest rates and are usually backed against your existing real estate.

Another option is a home equity line of credit (HELOC). If you have a significant amount of equity in your existing property, you might be eligible for a HELOC, which allows you to borrow against your existing home equity. They generally have lower rates and more favorable terms than bridge loans.

Finally, you can consider borrowing against your 401K. This option requires repayment within a certain time to avoid taxes or penalties, and repayments must be made with interest.

Using the Equity of Your Current Home for Financing

If you’ve built up a good amount of equity in your current home, you might be able to borrow against it using a home equity loan or a HELOC. These options provide a revolving line of credit or a lump-sum payment that can be applied towards construction costs. This can be a cheaper loan option than a construction loan when determining a construction to permanent loan, but be aware that it doesn’t come with the same protections.

At Bonsai Builders, we understand the complexities of financing a new home construction while owning another home. We’ve partnered with Enhancify to offer flexible financing options for your home improvement projects, with benefits including soft credit pulls, instant results, and loan requests up to $200,000.

Navigating financing can be complex, but with the right guidance and planning, you can make the dream of building a new home while owning another a reality.

Step 3: Plan Your New Home Construction

Now that you’ve grasped the financial aspects of how to build a new home while having ownership of another, it’s time to dive into the actual planning process. This involves finding the right builder, setting up a timeline for the construction, and sticking to a firm budget.

Finding the Right Builder for Your New Home

Building a new home is a team effort, and at the forefront of this team is your builder. Assembling a team of professionals who can bring your vision to life is crucial.

At Bonsai Builders, we pride ourselves in our ability to translate your vision into a practical and aesthetically pleasing design. We navigate building codes and zoning regulations, ensuring your home is built to the highest standards.

Consider the builder’s reputation and experience in building custom homes. Don’t hesitate to ask for references and past projects. This is not just about building a house – it’s about building your house.

Creating a Timeline for Buying Land, Hiring an Architect, and Building Your New Home

Timelines are essential, especially when you’re building a new home while selling your existing one. You’ll need to coordinate the buying of the land, hiring the architect, and the actual building process. If a builder, like us at Bonsai Builders, is offering new construction on a plot they already own, that can simplify things. However, understanding the timing is still crucial.

Create a detailed timeline that covers every step from buying the land to moving into your new home. Adjust the timeline as needed, but always have a clear plan to follow.

Setting a Firm Budget for Construction and Selling Costs

Budgeting is a critical aspect of any construction project. Without careful planning, costs can quickly outgrow your initial estimates. Your budget should include construction costs, selling costs, and ensure that you can still afford to pay your existing mortgage payment while the process plays out.

Start by researching construction costs and selling costs. Then, create a realistic budget that includes a buffer for unexpected costs. At Bonsai Builders, our team can help you understand all the costs involved and create a budget that fits your financial situation.

Planning your new home construction is an exciting step in the journey of building a new home while owning another. By choosing the right builder, creating a detailed timeline, and setting a firm budget, you’ll be well on your way to owning your dream home.

Bonsai Builders is here to guide you every step of the way, ensuring a stress-free and enjoyable experience, helping you in securing financing and the process of mortgage payments.

Step 4: Manage the Sale of Your Existing Home

Now that you’ve got a handle on your finances and the construction plan for your new home, let’s focus on selling your existing home.

Working with a Real Estate Agent to Sell Your Old Home

The first step in selling your current home is finding a competent real estate agent. A good agent can help you navigate the complex home selling process, ensuring a smooth transition. They can help you accurately price your house, stage it for potential buyers, and negotiate the best possible deal.

Setting Up Sales Contingencies to Protect Your Financial Stability

One way to ensure you’re not left in the lurch during the transition is by setting up a sales contingency for your current home. This basically means that the buyers of your home can’t move in until your new home is ready. This is not the only solution, as many different contract contingencies can be used to safeguard your interests.

Considering Rent-Back Agreements and Short-Term Housing Options

It’s also a good idea to have a backup plan. After selling your home, you may need to find a temporary place to live until your new home is ready to move into. You could consider options like short-term renting or even staying with family.

Alternatively, you could negotiate a rent-back agreement with the buyers of your home. This allows you to stay in your old home for a certain period after closing, giving you more time to move into your new place.

At Bonsai Builders, we understand that figuring out how to build a new home while having ownership of another can be challenging. But with careful planning and the right team by your side, you can smoothly navigate this transition and enjoy the journey towards your dream home.

Step 5: Navigate the Transition Period

Living in an existing home while building a new one can be a complex process, yet it’s an exciting journey towards your dream home. This phase requires understanding the legal implications, planning for potential challenges, and learning throughout the process.

Understanding the Legal Implications of Moving into a Home with a Construction Only Loan

One of the key steps in understanding how to build a new home while having ownership of another is to comprehend the legal implications involved. If you have opted for a construction loan, know that it’s not a traditional mortgage.

Depending on the type of construction loan you secure, you may be required to pay for construction costs immediately upon completion of your home. Alternatively, some loan types will roll over to a more traditional mortgage once construction is complete.

At Bonsai Builders, we always recommend our clients to consult with their lender and a legal advisor to understand all the nuances associated with their specific construction loan.

Planning for Potential Challenges and Delays in the Construction Process

As with any construction project, expect the unexpected. Whether it’s a delay due to weather or a change in material availability, be prepared to adapt and make changes as needed. Regular communication with your builder is crucial to address any issues promptly and keep the project on track.

We at Bonsai Builders recommend keeping a contingency fund for unexpected costs related to the construction of your home. Always remember, that staying on budget is a crucial aspect of building a new home while owning another.

Bonsai Builders: Your Partner in Building a New Home While Owning Another

Building a new home while owning another can be a challenging process, but it doesn’t have to be a stressful one. At Bonsai Builders, we are a family-owned business, here to help you navigate this exciting journey to your dream home.

Bonsai Builders’ Expertise in Luxury Home Construction and Remodeling

With over 26 years of experience in the industry, we’ve honed our skills in delivering top-notch luxury home construction and remodeling. We believe that every home should be a true reflection of the homeowner’s personality and taste. Our team of professionals works meticulously to ensure that every detail is perfected, from the foundation to the finishing touches.

How Bonsai Builders Can Help You Navigate the Process of Building a New Home While Owning Another

Understanding how to build a new home while having ownership of another can be complex, but we are here to simplify the process. We can assist you with financing options, planning your new home construction (to begin building), managing the sale of your existing home (in hopes to sell your home), and navigating the transition period.

We can provide you with a clear construction timeline, from securing permits to the final construction stages. Our team can also help with understanding local building codes and regulations, and ensuring that your new home project adheres to these.

When it comes to selling your old home, we can help you connect with experienced real estate agents. They can assist in selling your home swiftly and at a profit, helping to lessen the financial burden of owning two properties simultaneously.

Serving Clients Across Massachusetts with Master Craftmanship, Exquisite Designs, and Impeccable Taste

Our commitment to master craftsmanship, exquisite designs, and impeccable taste sets us apart. At Bonsai Builders, we understand the needs of high-end homeowners in Massachusetts. We are dedicated to delivering luxury homes that are not only aesthetically pleasing but are also functional and sustainable.

We believe that every home is unique, and our team is committed to bringing your vision to life. Whether you’re planning a second-story addition, a horizontal expansion, a basement remodel, or even an in-law suite, we are equipped to deliver a high-end, luxury service that exceeds your expectations.

Beginning on the journey of building a new home while owning another is a significant step. It requires careful planning, financing, and execution. But with Bonsai Builders, you won’t have to navigate this journey alone. Let us be your trusted partner in this exciting chapter of your life.

Contact us today, and let’s start building your dream home together.

Our Content

Our experienced contractors and design specialists carefully review and edit all content ensure it meets our high standards for quality and accuracy. We do this to provide our readers with content that is accurate, reliable, and up-to-date. Bonsai Builders, located in Sutton, Massachusetts is a trusted neighborhood building source across Massachusetts for kitchen remodeling, interest rate, closing costs, second mortgage, old house, current house, enough funds for a new build and more with over 26 years experience and over 125 jobs completed. Bonsai Builders has renovated many split level home kitchens across Massachusetts. Bonsai Builders is selected as best of Houzz year after year further showing their expertise and trust among homeowners in Massachusetts